"This will be an exciting and challenging task for us. Nordic small-cap listed companies have historically delivered high returns, and we believe this is a prudent use of the state' savings. We will also build on our broad knowledge of the Nordic financial markets and use this opportunity to develop further as an asset manager," says CEO Kjetil Houg.

The road ahead

Folketrygdfondet already has a project group in place, which is well underway in assessing the needs of the new unit.

"Now begins the process of recruiting key personnel and setting up the infrastructure needed to launch the new fund," Houg explains.

Houg emphasizes that it will take time before the organization is operational.

"Our goal is to build something that can deliver competitive results over time. Therefore, it's important that the new team has enough time to understand the mission and how to build the new portfolio."

This will be the State fund in Tromsø

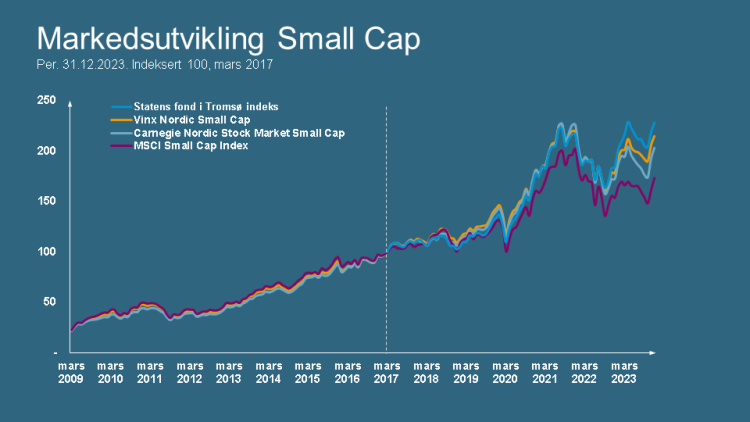

In the revised national budget for 2024, the government proposed an investment framework for the fund of NOK 15 billion, which could be increased to NOK 30 billion once some experience is gained. The fund will invest based on a market-weighted index consisting of Nordic small-cap listed companies.

Just under half of the reference index consists of Swedish companies, followed by Danish (22%), Finnish (13%), Norwegian (9%), and Icelandic (6%) companies. The relatively low exposure to Norway is mainly due to the fact that many Norwegian companies are already included in the index for the Government Pension Fund Norway.

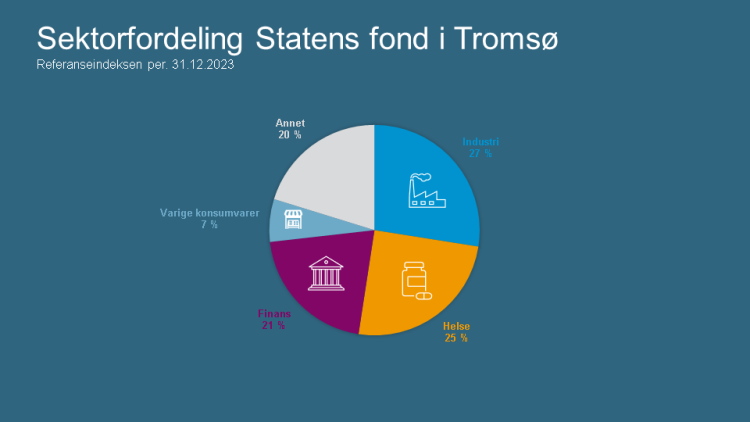

The three largest sectors are industry, healthcare, and finance. The proposed reference index will consist of 344 Nordic small-cap companies with a total market value of NOK 1,506 billion, adjusted for free float.