Our funds

Content on this page

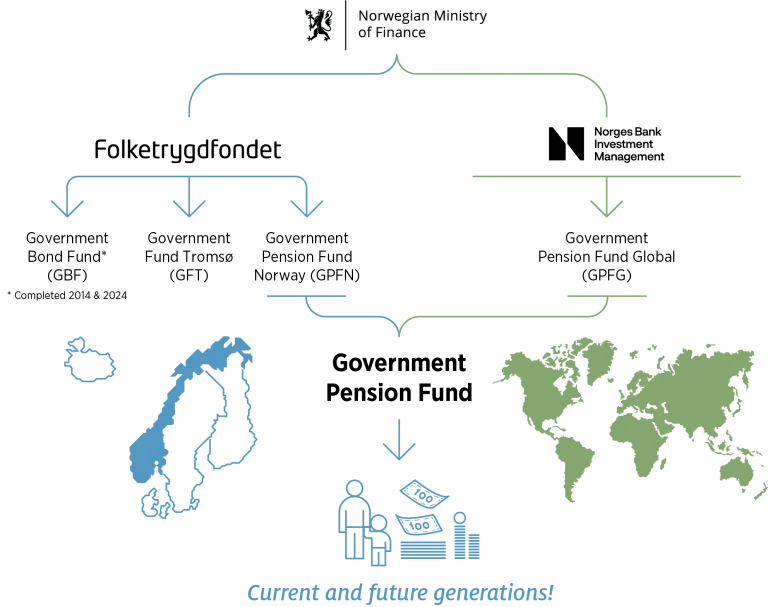

Folketrygdfondet was established in 1967 and has managed the Government Pension Fund Norway (GPFN) since 2007 when the Government Pension Funds was established as a joint structure for the Government Pension Fund Global (the “Oil Fund”) and the Government Pension Fund Norway.

In June 2024, Parliament passed the Law on Government Fund Tromsø (GFT). In addition, the responsibility of managing the Government Bond Fund (SOF) has been given to Folketrygdfondet on two occasions as a stabilising measure for the Norwegian economy.

Government Pension Fund Norway

The Government Pension Fund Norway (GPFN) is a continuation of the capital from the original Folketrygdfondet, which was established in 1967. Up until 1979, NOK 11.8 billion was transferred to the fund, which was the last year of capital inflow.

The increase in market value since 1979 can be attributed to the management of the fund, and since 1998 the return has been over 7 percent annually. The management has also created excess return every single year since 2015 and now accounts for more than 15 percent of the fund's value.

In 2006, the account loan scheme of approximately NOK 100 billion was discontinued, beyond which no capital has been withdrawn from the fund as of 2024. However, in June 2024, Parliament decided to start annual withdrawals from 2025 to finance the state budget.

Investment universe

The mandate for the management of GPFN states that "Folketrygdfondet shall seek to achieve the highest possible return after costs over time". Folketrygdfondet makes its investment decisions on an independent basis within the framework of the mandate. Furthermore, the mandate specifies that Folketrygdfondet shall conduct responsible investment activities and contribute actively to developing good national standards for responsible investments and the exercise of ownership.

Folketrygdfondet has internal guidelines for integrating considerations of good corporate governance, environmental and social conditions into its investment activities. The exercise of ownership shall safeguard the fund's financial interests and be based on the UN Global Compact and the OECD guidelines for the exercise of ownership and for multinational companies.

Government Fund Tromsø

In June 2024, Parliament passed the Law on Government Fund Tromsø. The fund will invest in small -cap companies in the Nordic region. The initial capital is NOK 15 billion, which can be considered increased to NOK 30 billion once some experience has been gained.

The benchmark index is a market-weighted Nordic index for small-cap companies with a total market value of approximately NOK 1,500 billion, adjusted for free float, and adjusted for companies that are already included in the GPFN benchmark index.

Swedish companies account for approximately half of the investment universe, followed by Danish (22 percent), Finnish (13 percent), Norwegian (9 percent) and Icelandic (6 percent) companies. The three largest sectors will be industrials (27 percent), health care (25 percent) and financials (21 percent).

Government Bond Fund 2020

The Government Bond Fund was established in March 2020 as a measure to facilitate access to liquidity for major companies in response to the coronavirus outbreak. Folketrygdfondet has been given responsibility for the management of the fund, which has a starting capital of NOK 50 billion.

The assets in the Government Bond Fund were placed at market terms, and the fund was invested in interest-bearing instruments issued by Norwegian companies. All sectors and industries were considered, including the high yield segment and both the primary and secondary markets. The Government Bond Fund was not invested in issuers with a rating of CCC/Caa2 or lower.

The bond fund is a temporary measure. After a build-up phase, the management of the fund will be gradually reduced. This will happen as the bonds mature and through sales when the market situation normalizes. A plan for liquidation was adopted in the autumn of 2022 with the goal of liquidation by the end of 2025.

A total of just over NOK 9.1 billion was invested with a result of NOK 957 million after costs. No benchmark index was set for the fund. The fund has now been liquidated within the adopted timetable.

Government Bond Fund 2009

The Government Bond Fund was established in March 2009 as a measure during the financial crisis to contribute to increased liquidity and access to capital in the Norwegian credit bond market. At its inception, NOK 50 billion was added to the fund and Folketrygdfondet was given the responsibility to manage the fund.

The assets in the Government Bond Fund were placed at market terms, and the fund was invested together with other investors within the individual loans. The mandate required that the capital should be placed in interest-bearing securities issued by enterprises domiciled in Norway.

The mandate given for the management of the Government Bond Fund stipulated that Folketrygdfondet should submit a plan for liquidation by 31 December 2013. The Ministry of Finance determined that the Government Bond Fund was in a build-down phase as of 21 March 2014 and that no new funds should be placed in the bond market.

As of 30 June 2014, all securities in the Government Bond Fund had been disposed of, and NOK 52,332 million had been transferred to the government's current account.